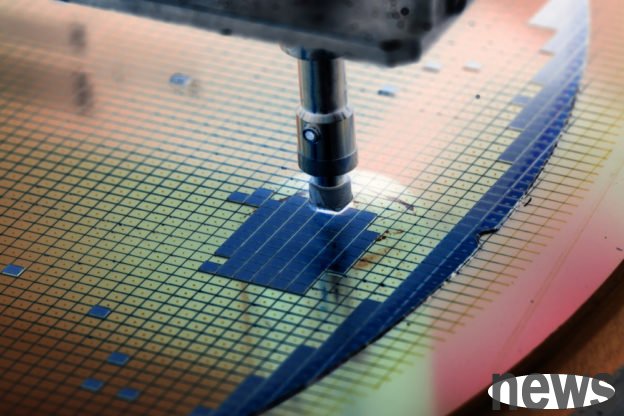

US President Trump said earlier this week that he would levy 100% tax on all US chips and semiconductors, which would inspire large semiconductor companies to rise to stock prices, but many smaller-scale businesses are confused and eager to understa...

US President Trump said earlier this week that he would levy 100% tax on all US chips and semiconductors, which would inspire large semiconductor companies to rise to stock prices, but many smaller-scale businesses are confused and eager to understand the possible impact.

According to a report by the United States, Limor Fried, founder and engineer of Adafruit Industries, a small New York electronics product maker, said, "We are still waiting for official guidance."The chips used in Adafruit products include products from American businessmen and vendors, and directly from Philippine and Taiwanese companies.

Furritt said that if these chips cannot be exempted from taxes, "it will push up our design costs because semiconductors are the most expensive zero-assembly parts in our product portfolio. For many of these taxes, we usually have to wait until we receive the bill to know the actual impact, and then adjust the price to increase the cost."

The number of chips directly imported by the United States is relatively small, because most non-US made chips have been packaged in products such as automobiles and Apple's smart phones and iPhones before entering the United States, or become part of the product.

Martin Chorzempa, a Chinese expert at the Peterson Institute for International Economics, said: "The question that industry people are really concerned about is whether the zero components will be taxed, that is, whether the chips in the device need to be individually calculated."

On the 6th of this month, Trump announced that he would charge 100% taxes to US chips and semiconductor classes and said that companies that promised that US factories or US factories will be exempt from import taxes.

Although Huaer Street investors interpreted the news as a benefit, not only American companies such as Intel and NVIDIA, but also good news for Asian chip manufacturers such as TSMC and Samsung, which are committed to American factories.

However, for smaller European and Asian chip operators, there is more uncertainty; these companies are not closely related to the trend of artificial intelligence (AI), but the semiconductors they produce are still widely used in daily necessities such as automobiles or washing machines.

German semiconductor giant Infineon Technologies said via email on the 7th: "The company cannot recommend possible semiconductor taxes and Trump's statements because the official has not issued any official documents at present."

Ma Yongzhe pointed out that these manufacturers "may not be large enough to enjoy exemptions, and they are likely not sufficient capital and profit to support large-scale investments in the United States."

The Semiconductor Industry Association (SIA) said today that they are "urgent to learn more about chip taxes, including the scope and structure of exemptions."

Extended reading: Trump sacrifices chips 100% tax, aesthetician: NT$ may be exempted first US 100% tax-related Taiwan's electricity is not ineffective. Experts: Pay attention to the proportion of production of Taiwan's semiconductors